The United Indian

Aadhaar, the unique 12-digit identification number issued by the Unique Identification Authority of India (UIDAI), has become an integral part of India's digital revolution. One of its most significant applications is the Aadhaar Enabled Payment System (AePS). This innovative system has transformed the way financial transactions are conducted in India, especially in rural and semi-urban areas.

What is AePS?

Background

With members representing the RBI, the Unique Identification Authority of India, the NPCI, the Institute for Development and Research in Banking Technology, and a few special invitees representing banks and research institutions, the RBI formed two working groups on MicroATM standards and Central Infrastructure & Connectivity for Aadhaar-based financial inclusion transactions in an effort to accelerate the nation's financial inclusion efforts.

The RBI has received the report from the working group on Central Infrastructure & Connectivity & MicroATM standards. In order to validate the effectiveness of MicroATM standards and transactions utilizing Aadhaar before they are implemented in practice, the working group suggested conducting a lab-level Proof of Concept (PoC) that integrates the authentication and encryption standards of UIDAI. Several locations successfully exhibited the PoC. Thus gave birth to Aadhaar Enabled Payment System (AePS).

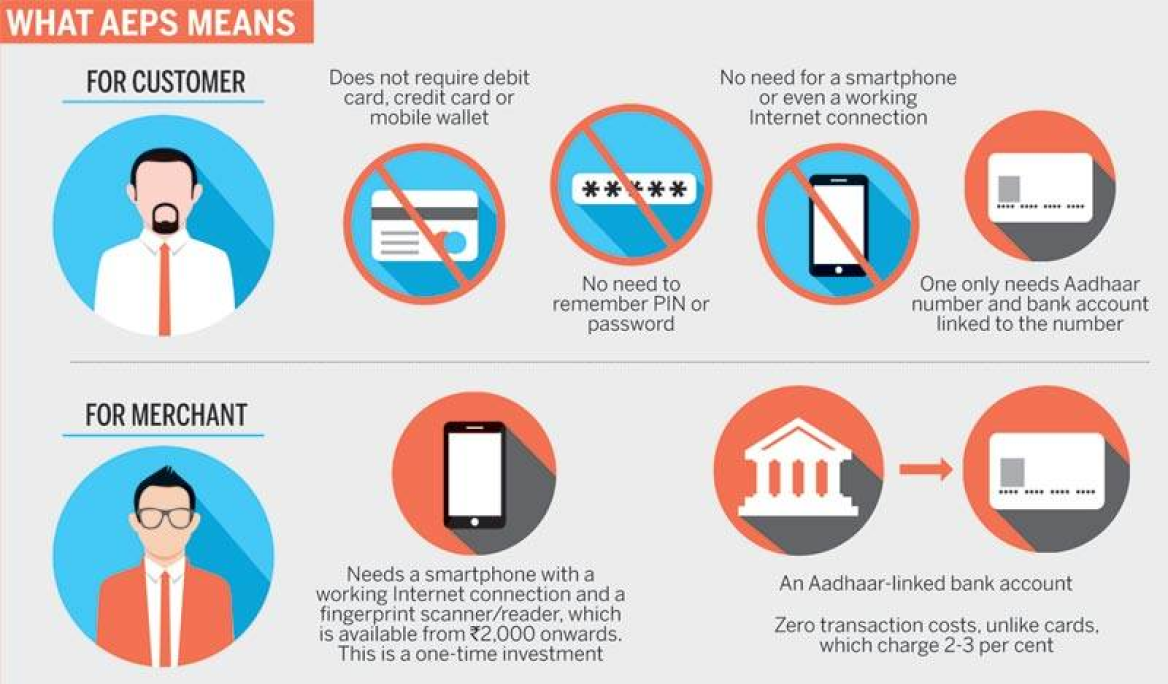

At its core, Aadhaar Enabled Payment System (AePS) is a bank-led model that allows online interoperable financial inclusion transactions at Point of Sale (PoS) terminals through the Business Correspondent (BC) of any bank using Aadhaar authentication. In simpler terms, it enables individuals to perform various banking transactions, such as cash withdrawal, cash deposit, balance inquiry, Mini Statement and fund transfer, using their Aadhaar number and biometric authentication (fingerprint or iris scan) at designated outlets like bank branches, post offices, and other authorized locations.

How does AePS work?

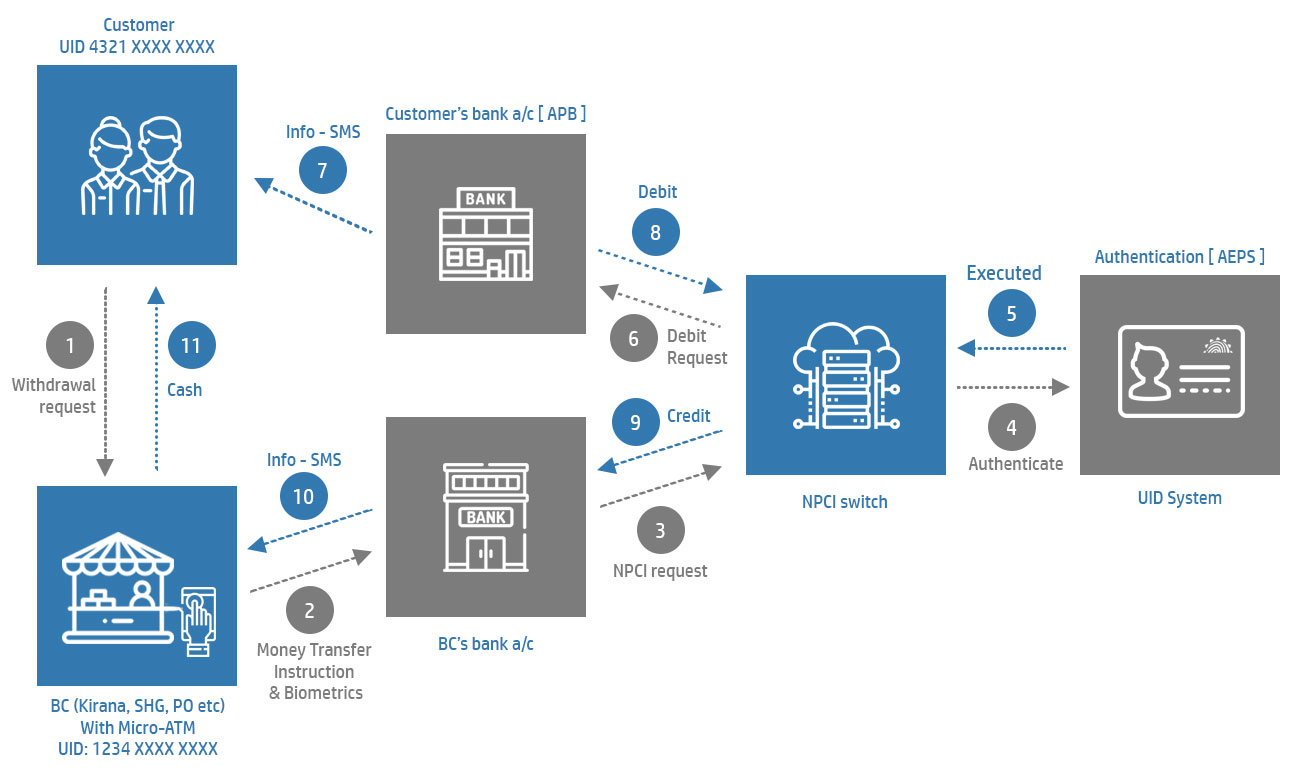

To use AePS, an individual needs to have a bank account linked to their Aadhaar number. The process involves the following steps:

- The individual visits an AePS outlet.

- The BC operator enters the individual's Aadhaar number and selects the desired transaction type (cash withdrawal, deposit, etc.).

- The individual is asked to authenticate themselves using their fingerprint or iris scan.

- Once the authentication is successful, the transaction is processed, and the funds are transferred to or from the individual's bank account.

- The NPCI AePS solution can be accessed at any biometric-enabled touch-point via Micro ATMs, which may be all-in-one integrated devices, or mobiles /PCs/tablets, with accessories that meet technical specifications defined by UIDA

Key Benefits of AePS

Aadhaar Enabled Payment System (AePS) has brought about several benefits to the Indian population, particularly those residing in rural and remote areas:

- Financial Inclusion: AePS has significantly expanded financial inclusion by providing access to banking services to millions of people who were previously unbanked or underbanked. This also includes checking for Direct Benefit Transfer beneficiaries to receive DBT, Social Security Pension or government subsidies.

- Convenience: AePS eliminates the need for physical bank visits, making it convenient for people to access their accounts and perform transactions at their nearest AePS outlet.

- Security: Aadhaar-based authentication adds an extra layer of security to transactions, reducing the risk of fraud and unauthorized access.

- Efficiency: AePS transactions are processed quickly and efficiently, saving time and effort for both customers and service providers.

- Government Benefits: AePS is used to disburse government subsidies and welfare benefits directly to beneficiaries' bank accounts, ensuring transparency and accountability.

Business Uses of the AePS Service

AePS offers a wide range of benefits for businesses and individuals alike:

1. Enhanced Customer Convenience

- Aadhaar-Based Access: Customers can conveniently access their Aadhaar-linked bank accounts and perform basic banking transactions using their Aadhaar number or Virtual ID.

- Simplified Transactions: This streamlined process reduces the need for physical documentation and speeds up transaction times.

2. Interoperable Financial Services

- Seamless Transactions: AePS facilitates smooth and secure financial transactions across various banks and entities.

- Standardized Platform: This interoperability ensures a consistent and efficient experience for customers.

3. Efficient eKYC Services

- Remote Account Opening: Residents can open bank accounts with any bank, regardless of location, using Aadhaar as proof of identity and address.

- Real-Time Verification: AePS provides a real-time electronic KYC platform, helping banks and non-bank entities verify customer identities.

- Cost-Effective and Secure: This paperless KYC process reduces costs and improves security by eliminating the need for physical documents.

4. Facilitated Merchant Transactions

Aadhaar-Based Payments: Merchants can accept payments using customers' Aadhaar numbers or Virtual IDs and biometric authentication.

Simplified Checkout: This convenient payment method streamlines the checkout process for both merchants and customers.

Is AePS Really Safe?

While AePS offers a convenient and efficient way to conduct financial transactions, it's essential to address concerns about security. The system relies on biometric authentication, which is generally considered secure. However, it's crucial to choose reputable AePS outlets and be cautious when sharing personal information.

To ensure safety, always verify the authenticity of the AePS outlet and the agent. Avoid sharing your Aadhaar number or biometric details with unauthorized individuals. Additionally, keep an eye on your bank account balance and transaction history to detect any irregularities. If you suspect any fraudulent activity, report it immediately to your bank or the relevant authorities.

By following these precautions, you can minimize the risks associated with using AePS and enjoy its benefits with confidence.

Challenges and Concerns For Aadhaar Enabled Payment System

While Aadhaar Enabled Payment System (AePS) has been a game-changer, it is not without its challenges:

- Digital Literacy: Some individuals, especially in rural areas, may lack the necessary digital literacy to use AePS effectively.

- Infrastructure: Reliable internet connectivity and power supply are crucial for the smooth functioning of AePS, but these may not be readily available in all areas.

- Security Risks: Despite the security measures in place, there is always a risk of cyberattacks and data breaches, which could compromise user data and financial information.

- Privacy Concerns: Some people may have concerns about the privacy implications of using Aadhaar for financial transactions.

Future of AePS

The future of Aadhaar Enabled Payment System (AePS) looks promising, with ongoing efforts to further enhance its capabilities and address the challenges:

- Expanding Accessibility: The government and banks are working to expand the network of AePS outlets to reach more people, especially in underserved areas.

- Improving Digital Literacy: Initiatives are being undertaken to educate people about the benefits of digital financial services and how to use AePS effectively.

- Strengthening Security: Robust security measures are being implemented to protect user data and prevent fraudulent activities.

- Exploring New Use Cases: AePS is being explored for new use cases, such as micro-insurance, micro-loans, and bill payments.

Conclusion

Aadhaar Enabled Payment System (AePS) has emerged as a powerful tool for financial inclusion in India. By leveraging the power of technology and Aadhaar authentication, AePS has made it easier for millions of people to access banking services and participate in the formal economy. While challenges remain, the future of AePS is bright, and it is poised to play a pivotal role in India's journey towards a cashless and digitally empowered society.

Read more in Economy

Jun 24, 2025

TUI Staff

Jun 22, 2025

TUI Staff

Stay Tuned with The United Indian!

Our news blog is dedicated to sharing valuable and pertinent content for Indian citizens. Our blog news covering a wide range of categories including technology, environment, government & economy ensures that you stay informed about the topics that matter most. Follow The United Indian to never miss out on the latest trending news in India.

©The United Indian 2024