The United Indian

Education is widely regarded as the passport to a brighter future. In India, a country with a young and ambitious population, pursuing higher education is seen as a key factor in achieving social mobility and economic prosperity. However, the rising cost of quality education has made it increasingly difficult for many students to finance their academic dreams.

This is where student loans step in, offering a lifeline to students from diverse financial backgrounds. But are student loans a boon or a bane for Indian students? Let's delve deeper into this complex issue.

Understanding Student Loans

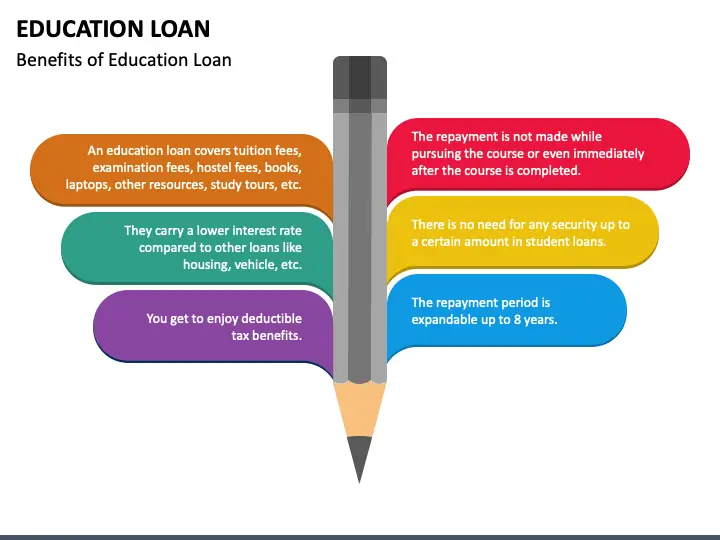

A student loan is a financial aid provided by banks or government institutions to help students cover the costs associated with higher education. These costs can include tuition fees, hostel expenses, books and study materials, examination fees, and even laptop purchases. Student loans in India typically come with a fixed interest rate and a repayment period that kicks in after a grace period following the completion of your studies.

How Student Loans Work in India ?

In India, student loans bridge the gap between educational costs and a student's financial resources. Offered by banks and government institutions, these loans cover expenses like tuition, hostel fees, and books. You can apply after receiving a university acceptance letter. Loan approvals depend on your academics and creditworthiness (or a co-signer's). Once approved, the bank disburses the funds directly to the institution. Repayment typically starts after a grace period following your studies and stretches over several years. Remember, these loans come with interest, so careful planning and responsible borrowing are crucial.

Types of Student Loans in India

There are various types of student loans in India, catering to different needs and educational aspirations:

- Secured vs. Unsecured Loans: Secured loans require you to pledge collateral, such as property or a fixed deposit, to secure the loan. These typically offer lower interest rates. Unsecured loans, on the other hand, don't require collateral but come with higher interest rates.

- Loan amount: Loan amounts vary depending on the lender, the type of program you're pursuing (undergraduate, postgraduate, professional), and the institute you're enrolled in. Some lenders offer loan amounts specifically for studying abroad.

- Course-specific Loans: Some banks and government schemes offer loans specifically targeted towards particular courses like medicine, engineering, or management. These loans might have specific eligibility criteria or interest rate benefits.

- Government Sponsored Loans: The Government of India offers several scholarship and subsidy schemes to ease the burden of student loans, particularly for students from socially and economically disadvantaged backgrounds.

Student Loans in India: A Double-Edged Sword

Student loans in India are a double-edged sword for aspiring students. While they offer the undeniable merit of unlocking educational doors, they also come with the potential burden of debt. Let's delve into the merits and demerits of student loans in India.

Merits

- Accessibility to Quality Education: Student loans break down financial barriers, allowing students from diverse backgrounds to pursue higher education in prestigious institutions. This promotes social mobility and creates a more equitable playing field in the job market.

- Investment in Human Capital: Education is an investment in human capital. By financing their studies, students acquire valuable skills and knowledge, leading to higher earning potential in the future. This not only benefits the individual but also fuels the nation's economic growth.

- Flexible Repayment Options: Most student loans in India can be availed offer student loans with extended repayment periods, often stretching up to 15 years after course completion. This allows graduates to manage their finances comfortably once they start earning.

- Government Support: The Indian government offers various subsidy schemes to ease the burden for specific categories, such as students from disadvantaged communities or those studying abroad. Additionally, the interest paid on student loans can be claimed as a tax deduction, further reducing the financial strain.

Demerits

- Debt Burden: High student loan debt can be a significant financial burden for graduates, especially those entering fields with lower starting salaries. This can lead to delayed milestones like buying a house or starting a family.

- Pressure and Stress: The looming debt can be a source of immense stress and anxiety for young graduates. The pressure to secure a well-paying job to manage loan repayments can impact their mental well-being and career choices.

- Risk of Default: In an uncertain job market, there's a risk of graduates defaulting on their loans if they are unable to find suitable employment. This can negatively impact their credit score and create further financial difficulties.

- Unequal Access: Despite the availability of student loans in India, access might not be equal for all. Students from rural areas or economically weaker sections might face challenges with documentation or lack of awareness about loan schemes, hindering their chances of securing funding.

Basic Requirements and Application Procedure

Now since we can compare and decide if a student loan is something we wish to opt for, lets move to learn the basic requirements to apply for a student loan in India typically include:

- Being an Indian citizen between the age of 18 and 35 (age limits may vary)

- Having a valid admission letter from a recognized university/institution

- Meeting the academic eligibility criteria set by the lender (minimum percentage in previous exams)

- Good academic record

- Co-signer/guarantor (may be required for unsecured loans)

- Documentation: Proof of identity, address, income (of student or co-signer), and admission letter

The Application Process

- Research and Compare: To explore student loan options in India, check different banks, government schemes, and NBFCs (Non-Banking Financial Companies). Compare interest rates, processing fees, repayment terms, and any special features.

- Choose the Right Loan: Based on your financial needs, course type, and repayment capacity, select the loan that best suits your requirements.

- Collect Documents: Gather all the necessary documents as per the lender's requirements.

- Apply Online or Offline: Many banks and lenders offer online application processes for student loans. Alternatively, you can visit a branch and apply in person.

- Loan Approval: The lender will evaluate your application and creditworthiness before approving the loan.

- Loan Disbursement: Once approved, the loan amount will be disbursed directly to the educational institution or your bank account.

Things to Consider Before Taking a Student Loan

Taking on a student loan in India is a significant financial decision. Here are some key factors to consider before you sign on the dotted line:

Do you really need a loan?

Exhaust all other financial avenues first, such as scholarships, grants, parental support, or education-specific savings.

- How much do you need?

Create a detailed budget to determine the exact amount required for your education. Don't borrow more than you absolutely need.

- Interest rates and repayment terms

Understand the interest rate structure (fixed vs. floating) and the repayment period offered by different lenders. Choose a loan with a manageable repayment plan that fits your future income projections.

- Hidden fees

Be aware of any processing fees, prepayment penalties, or other associated charges with the loan.

- Employment prospects

Research the job market for your chosen field and consider the average starting salary. Ensure you can comfortably manage loan repayments with your projected income.

- Alternative financing options

Explore options like part-time work, internships, or education-based scholarships before relying solely on loans.

Government and Educational Institutions' Role

- Expanding Scholarship Programs: The government can increase funding for merit-based and need-based scholarships, reducing reliance on loans for deserving students.

- Interest Rate Subsidies: Offering interest rate subsidies, especially for students from underprivileged backgrounds, can significantly reduce the financial burden of student loans.

- Streamlining Loan Processes: Simplifying the application procedures of student loan in India and expediting approval times can make student loans more accessible, particularly for students in rural areas.

- Career Counseling Services: Universities can offer comprehensive career counseling services to help students make informed decisions about their academic pursuits and future careers, ensuring their chosen field aligns with good job prospects.

- Financial Literacy Programs: Integrating financial literacy programs into the education system can empower students to manage their finances effectively. This includes budgeting skills, responsible credit card use, and debt management strategies.

The Road Ahead

Student loans are a necessary reality for many students in India. By fostering a collaborative approach involving students, educational institutions, and the government, we can ensure that student loans remain a tool for empowerment, not a source of stress. By promoting financial literacy, responsible borrowing practices, and a supportive educational environment, we can help students leverage the benefits of student loans and achieve their academic aspirations without compromising their financial well-being. Remember, education is an investment, and student loans, when used wisely, can be a powerful tool to unlock a brighter future.

Conclusion

Student loans in India can be a powerful tool for educational advancement, but they should be approached with a strategic plan and careful consideration. By being financially responsible, choosing the right loan option, and planning for the future, students can leverage student loans to their advantage and pave the way for a successful career. Additionally, the government and educational institutions need to work together to create a supportive ecosystem that ensures student loans remain a stepping stone to a brighter future, not a burden that hinders progress.

Read more in Economy

Jul 17, 2025

TUI Staff

Jun 24, 2025

TUI Staff

Jun 22, 2025

TUI Staff

Stay Tuned with The United Indian!

Our news blog is dedicated to sharing valuable and pertinent content for Indian citizens. Our blog news covering a wide range of categories including technology, environment, government & economy ensures that you stay informed about the topics that matter most. Follow The United Indian to never miss out on the latest trending news in India.

©The United Indian 2024