The United Indian

Gold has long held a place of allure in the world of investment. Its historical stability and potential for appreciation make it a valuable asset class, particularly during times of economic uncertainty. However, traditional physical gold comes with its own set of drawbacks. Storage risks, purity concerns, and insurance costs can all chip away at the potential benefits. This is where Sovereign Gold Bond Returns (SGBs) emerge as a game-changer, offering a safe and secure alternative to owning physical gold.

Understanding Sovereign Gold Bonds (SGBs)

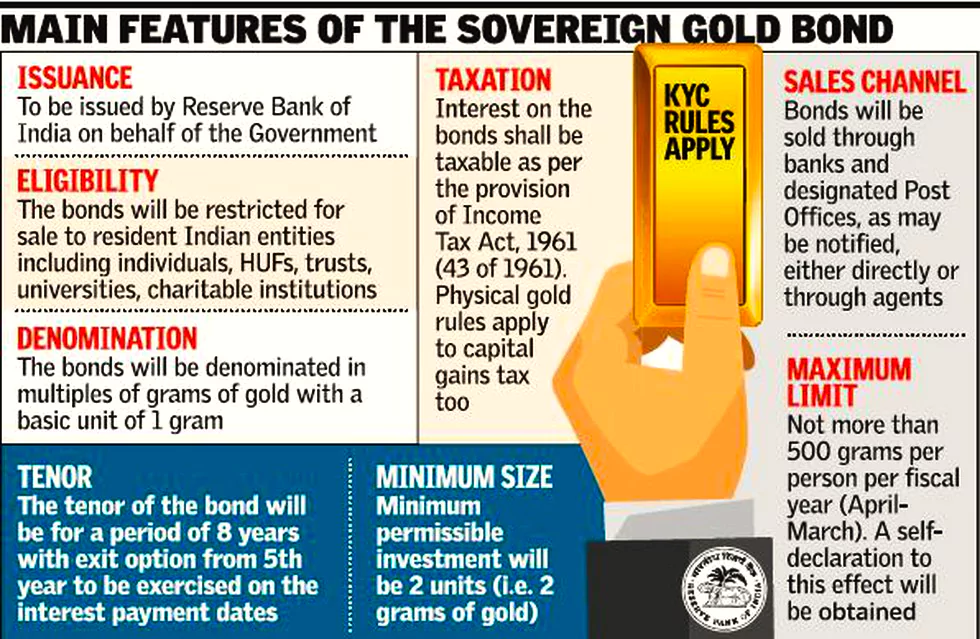

Issued by the Reserve Bank of India (RBI) on behalf of the Government of India, SGBs are essentially government securities denominated in grams of gold. Unlike physical gold, they are not actual gold coins or bars. Instead, they represent a paper (or dematerialized) claim on a specific quantity of gold. The value of your investment fluctuates with the market price of gold.

Why Consider SGBs? A Multifaceted Appeal

Gold Sovereign Bond Returns offer a unique blend of benefits that cater to various investor needs:

- Safety and Security: One of the most significant advantages of SGBs is their inherent safety. Unlike physical gold, which can be lost, stolen, or damaged, SGBs are held in demat form or in the RBI's books. This eliminates the risks associated with physical storage and insurance needs.

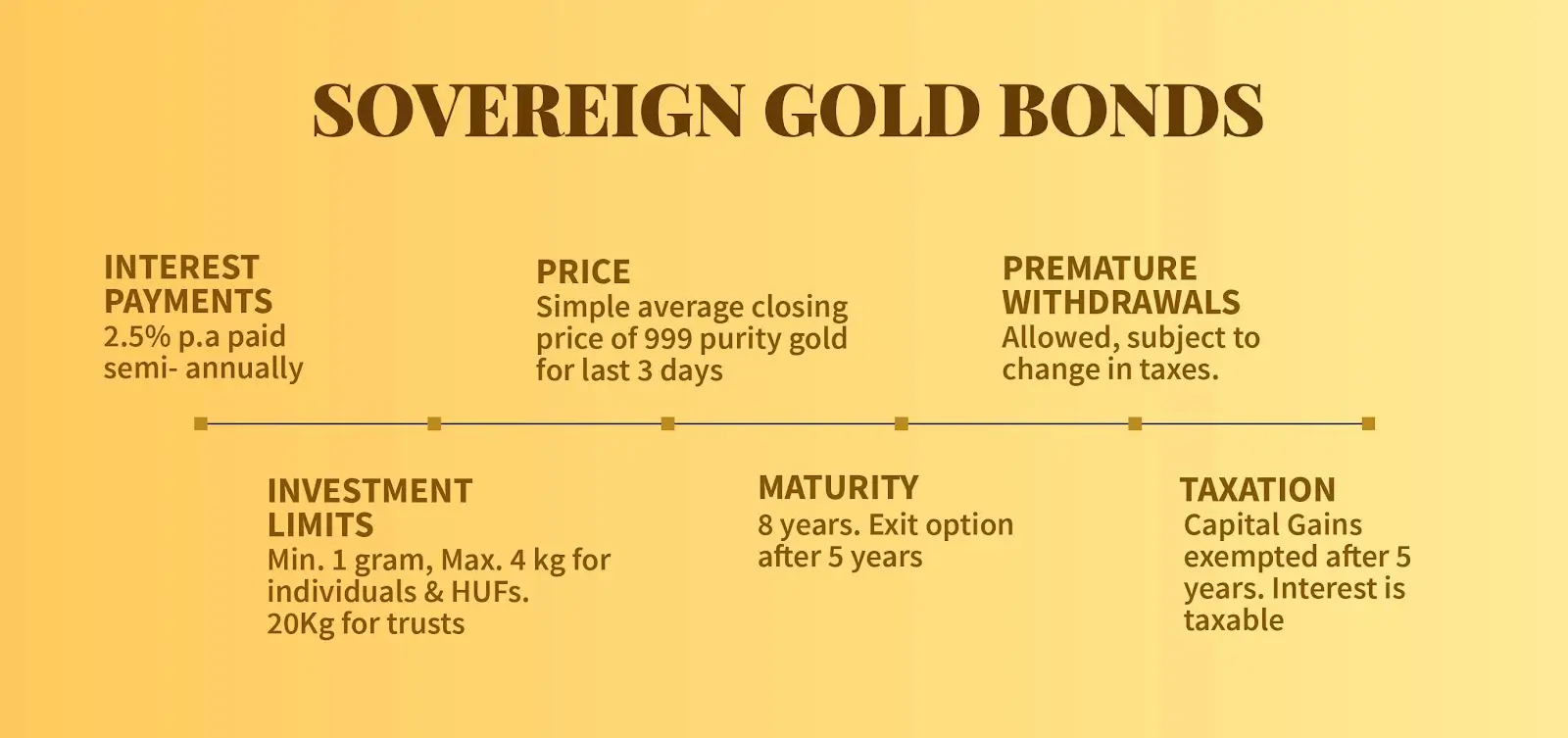

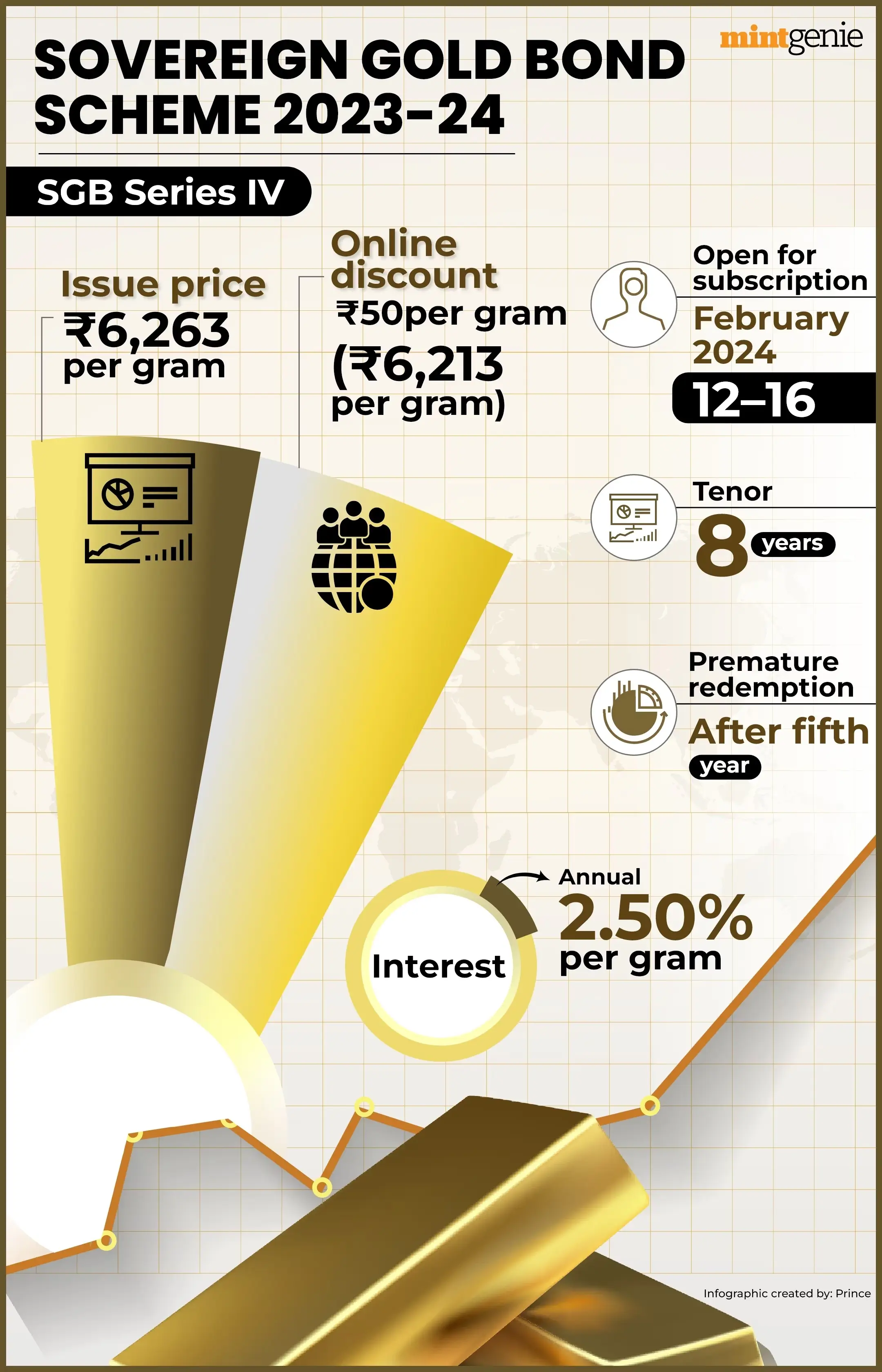

- Regular Interest: SGBs provide a guaranteed interest income of 2.5% per annum, paid semi-annually. This fixed interest offers a buffer against potential fluctuations in the gold price, providing a sense of stability and predictability to your investment.

- Potential for Capital Appreciation: The redemption price of SGBs is linked to the prevailing gold price at maturity. This means you benefit from any increase in gold prices over the investment period. If the gold price rises significantly, the potential for capital appreciation can be substantial.

- Tax Advantages: Gold Sovereign Bond Returns offer attractive tax benefits. If you hold them till maturity (8 years), you are exempt from capital gains tax. Additionally, the interest earned on SGBs is taxed as per your income tax slab, which can be beneficial depending on your tax bracket.

- Convenience and Accessibility: Investing in SGBs is a breeze. You can purchase them through authorized banks and agents in tranches, making them suitable for investors with varying budgets. The online application process further enhances convenience, allowing you to invest from the comfort of your home.

Demystifying the Mechanics: How Sovereign Gold Bond Returns Work

Imagine gold with a guaranteed return. SGBs are like that. Issued by the government, they represent grams of gold you purchase in cash. The value fluctuates with the gold price, but you also earn a fixed interest rate of 2.5% per annum, paid every six months. Unlike physical gold, SGBs are held securely in demat form or RBI custody, eliminating storage worries. There's a lock-in period of 8 years, with a limited exit option after the 5th year. Upon maturity, you receive the redemption price based on the average gold price over the past 3 days. It's a secure way to own gold and potentially benefit from its price increase, with guaranteed returns on top.

Maximize Your Gold Investment: Sovereign Gold Bonds Calculator

Unsure if Sovereign Gold Bonds (SGBs) are the right fit for your portfolio? Look no further than an sovereign gold bond calculator! These online tools help you estimate your potential returns by factoring in the investment amount, interest rate, and gold price fluctuations. You can even see a breakdown of your interest earned over the tenure and the potential maturity value based on current gold prices. This valuable tool allows you to make informed decisions by visualizing your returns and ensuring gold sovereign bond returns align with your investment goals.

Beyond the Basics: Distinguishing SGBs from Other Investments

While SGBs share some similarities with other investment options, the key differences that exists between the both are as follows:

- Comparison with Physical Gold: As discussed earlier, SGBs eliminate the risks and hassles associated with physical gold storage. Additionally, SGBs offer guaranteed interest income, which is absent with physical gold. However, unlike physical gold, SGBs don't provide the tangible satisfaction of owning a precious metal.

- Comparison with Gold ETFs (Exchange Traded Funds): Both SGBs and Gold ETFs offer exposure to gold prices. However, SGBs are government-backed securities, whereas Gold ETFs are market-linked instruments. SGBs offer a fixed interest rate, while returns from Gold ETFs depend on gold price movements. Additionally, SGBs have an 8-year lock-in period with a limited exit option, while Gold ETFs offer greater liquidity.

- Comparison with Mutual Funds: Mutual funds can invest in a variety of assets, including gold. Unlike gold sovereign bond returns, which directly track gold prices, gold-investing mutual funds may not perfectly mirror gold price movements. However, mutual funds offer diversification and professional management, which can be beneficial for some investors.

The Future of Sovereign Gold Bonds: A Gleaming Outlook

The future of SGBs appears promising. Several factors contribute to this optimism:

- Growing Demand for Gold: Gold's status as a safe haven asset is likely to continue. As economies fluctuate and geopolitical uncertainties arise, the demand for gold is expected to remain strong, potentially driving up SGB prices.

- Government Support: The Indian government has actively promoted SGBs as a way to reduce physical gold imports and encourage financial inclusion. This continued support is likely to bolster the popularity of SGBs.

- Technological Advancements: The increasing digitization of financial services can further simplify the purchase and management of SGBs. This makes them even more accessible to a wider range of investors.

Making an Informed Decision: Are SGBs Right for You?

Before investing in SGBs, it's crucial to consider your investment goals and risk tolerance. Here are some key factors to ponder:

- Investment Horizon: The 8-year lock-in period with a limited exit option can be a constraint for some investors. If you need access to your funds before maturity, SGBs might not be the ideal choice.

- Risk Tolerance: While Gold Sovereign Bond Returns offer some stability with their fixed interest rate, they are still subject to gold price fluctuations. If you are averse to any level of risk, SGBs may not be the best fit for your portfolio.

- Portfolio Diversification: SGBs are a valuable tool for diversification, but they shouldn't be the sole component of your investment strategy. Consider your overall asset allocation and risk profile before deciding on the weightage you want to allocate to SGBs.

Investing in SGBs: A Step-by-Step Guide

If you've decided that gold sovereign bond returns align with your investment goals, here's a basic roadmap to get you started:

- Stay Updated: Keep an eye on gold price trends and upcoming SGB issuance announcemen

- Choose an Authorized Agent: Select a reputable bank or agent authorized to sell SGBs.s. The RBI usually issues SGBs in tranches throughout the year.

- KYC Compliance: Ensure your KYC (Know Your Customer) documents are in order, as they are mandatory for investing in SGBs.

- Application and Payment: Submit the application form and make the required payment during the issuance period. You can invest online or through a physical branch.

- Demat Account or RBI Custody: Decide whether you want to hold your SGBs in demat form (linked to your demat account) or in the RBI's custody.

- Confirmation and Receipt: Upon successful application, you will receive a confirmation and holding certificate for your SGBs.

Conclusion: Sovereign Gold Bonds - A Secure Way to Embrace the Golden Opportunity

Sovereign Gold Bonds Returns offer a compelling proposition for investors seeking a secure and convenient way to participate in the gold market. With their guaranteed interest, potential for capital appreciation, and tax benefits, SGBs can be a valuable addition to a well-diversified portfolio. By understanding the unique features of SGBs and carefully considering your investment goals, you can make an informed decision about whether they are the right fit for your financial journey. Remember, SGBs are a long-term investment, and patience is key to reaping their full potential. So, embrace the golden opportunity that SGBs present and invest wisely!

Read more in Economy

Jun 24, 2025

TUI Staff

Jun 22, 2025

TUI Staff

Stay Tuned with The United Indian!

Our news blog is dedicated to sharing valuable and pertinent content for Indian citizens. Our blog news covering a wide range of categories including technology, environment, government & economy ensures that you stay informed about the topics that matter most. Follow The United Indian to never miss out on the latest trending news in India.

©The United Indian 2024