The United Indian

Retirement marks the culmination of one’s professional journey and the beginning of a new phase in life. Imagine yourself, a few years from now, with the freedom to pursue your passions, travel the world, or simply relax without financial worries. Retirement, that much-anticipated phase of life, holds immense promise. But to turn that dream into reality, planning is key. In India, unlike some other countries, the social security system offers limited coverage. This puts the onus of building a secure retirement corpus squarely on your shoulders. Yet, it remains a topic often overlooked until it's too late.

This blog dives deep into the world of retirement planning goals, equipping you with the knowledge and tools to navigate this crucial aspect of your financial journey.

Understanding Retirement in India

In India, retirement age varies across sectors and organizations, typically ranging from 58 to 65 years. With increasing life expectancy, retirement could span two to three decades, emphasizing the need for robust planning. Factors such as inflation, healthcare costs, and lifestyle choices significantly impact retirement expenses.

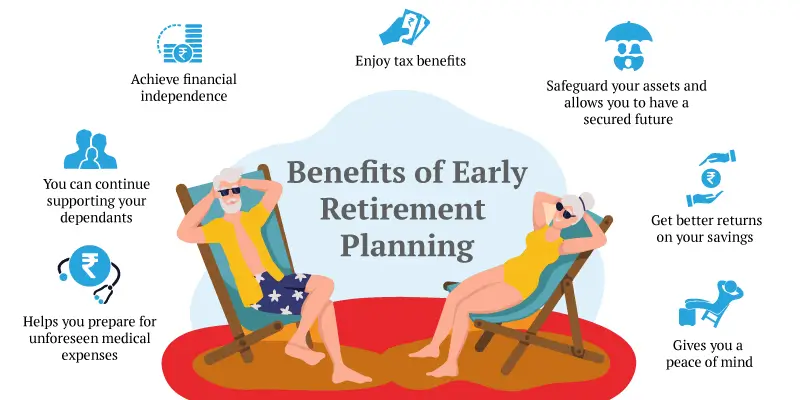

Why is Retirement Planning Important in India?

Unlike the West, India has a younger population, with a large portion yet to enter their retirement years. However, this doesn't make need for retirement planning any less important. Here's why:

- Limited Social Security: The Employee Provident Fund (EPF) offers some pension benefits, but for many Indians, especially independent professionals and the self-employed, building a sufficient retirement corpus becomes even more critical.

- Rising Medical Costs: Healthcare expenses tend to increase with age. Factoring in medical inflation is essential to ensure your retirement savings can meet your future needs.

- Increased Life Expectancy: People are living longer, and a well-planned retirement allows you to enjoy those golden years financially secure.

Defining Your Dream Retirement: Setting Retirement Planning Goals

Your retirement planning goals are the cornerstones of your entire retirement plan. They act as the guiding light, helping you determine how much you need to save, the investment avenues to choose, and the lifestyle adjustments you might need to make. Here's how to identify your ideal retirement:

Lifestyle: Imagine your perfect day in retirement. Do you crave adventure and travel, or a peaceful life closer to family? Will you continue working part-time, or fully embrace leisure? Envisioning your lifestyle helps you estimate your expenses.

Financial Security: Beyond your daily needs, consider if you have any aspirations like starting a business, supporting family, or leaving a legacy. Factor in potential healthcare costs and emergencies.

Location: Where do you see yourself living in retirement? Will you stay in your current city, downsize to a smaller home, or relocate to a new climate? All these question must forn an important part of you retirement planning goals. Consider the cost of living variations across locations.

Health and Wellness: Maintaining good health is crucial for a fulfilling retirement. Factor in potential healthcare costs and activities that promote physical and mental well-being.

By clearly defining your retirement goals, you can create a personalized roadmap that bridges the gap between your current financial situation and your desired future. Remember, your goals can evolve over time, so revisit and revise them periodically to ensure your plan stays aligned with your aspirations.

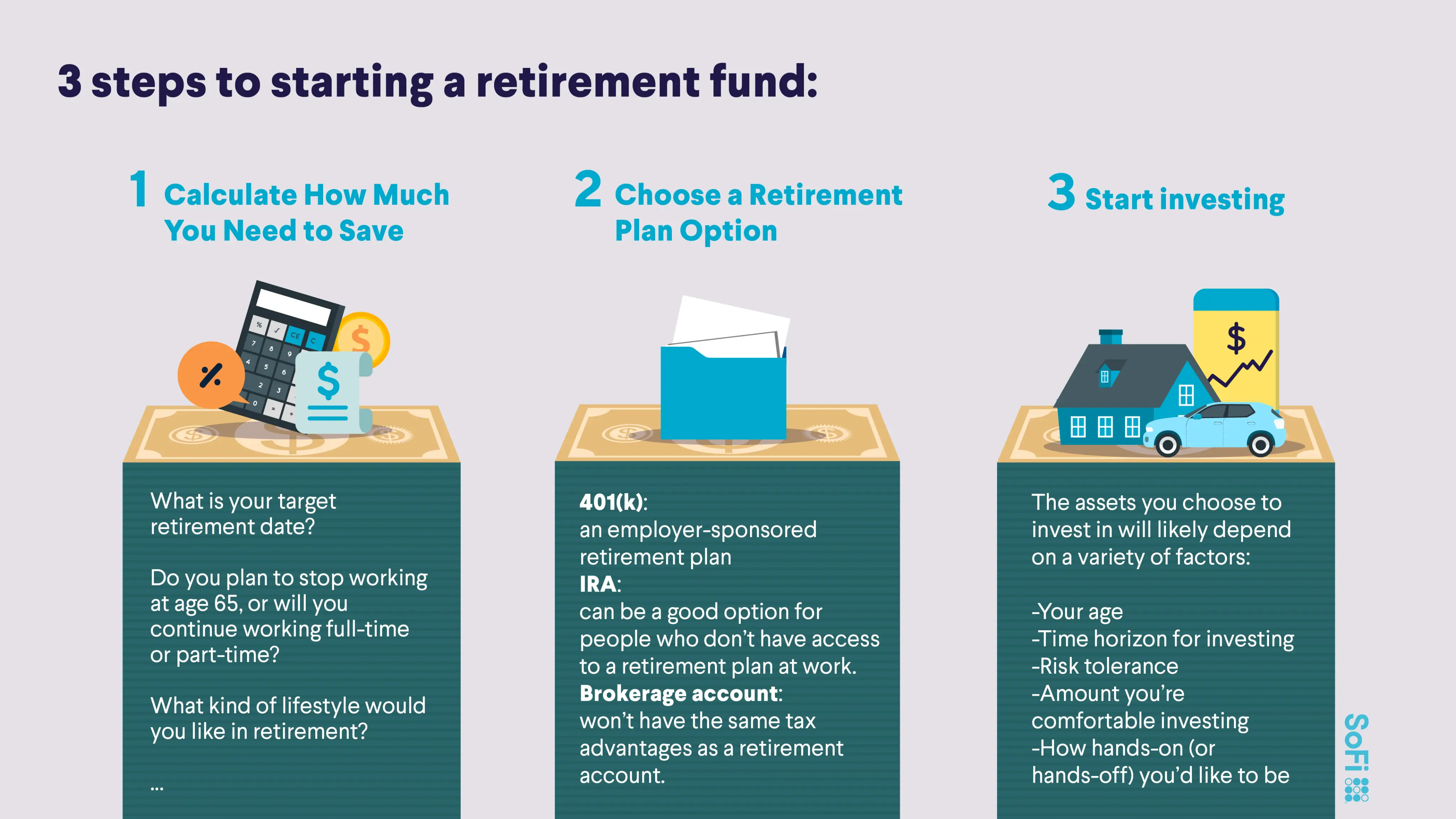

Getting Started: Steps to Retirement Planning

Here's a roadmap to guide you through retirement planning process:

- Set Your Retirement Goals: Visualize your ideal retirement lifestyle. Will you travel extensively? Downsize your living? These goals will determine the corpus you need to accumulate. Factor in inflation and healthcare costs to estimate future requirements accurately.

- Assess Your Current Financial Situation: Begin by evaluating current financial standing. Take stock of your income, expenses, existing debts, and current savings/investments. This will help you understand your starting point and how much you can realistically save.

- Calculate Your Retirement Corpus: There are online retirement calculators that can help you set your retirement planning goals. The give you an estimate the amount you'll need based on your life expectancy, desired lifestyle, and inflation. Considering sources like Employee Provident Fund (EPF), Public Provident Fund (PPF), National Pension System (NPS), and voluntary retirement schemes.

- Factor in Inflation: Remember, the value of money decreases over time. Inflation needs to be factored into your calculations to ensure your savings retain their purchasing power in the future.

- Choose the Right Investment Avenues: India offers a diverse range of investment options for retirement planning, such as equities, bonds, mutual funds, and real estate to optimize returns while minimizing risks. Start early to benefit from the power of compounding.

Investment Options for Retirement Planning in India

Now that you understand the retirement planning goals, let's delve into the vehicles that will help you reach your destination:

- Employee Provident Fund (EPF): This is a mandatory savings scheme for salaried individuals, where a portion of your salary and your employer's contribution goes towards a retirement fund.

- Employee Pension Scheme (EPS): This scheme provides a pension upon retirement based on your salary and contribution years.

- Public Provident Fund (PPF): This is a low-risk, government-backed savings scheme offering attractive tax benefits. It's a good option for those seeking guaranteed returns.

- National Pension System (NPS): This market-linked investment scheme offers a pension solution with market-linked returns and tax benefits. You can choose your asset allocation based on your risk tolerance.

- Unit Linked Insurance Plans (ULIPs): These combine insurance coverage with investment options, offering potential for higher returns but also carrying some risk.

- Mutual Funds: Mutual funds form an important part of retirement planning process as they allow you to invest in a diversified basket of stocks or bonds, offering the potential for significant growth but also subject to market fluctuations.

- Real Estate: Investing in property can provide rental income and potential for capital appreciation. However, it requires a significant initial investment and comes with its own set of management responsibilities.

- Senior Citizen Savings Scheme (SCSS): Designed for individuals aged 60 years and above, SCSS offers guaranteed returns and serves as a secure investment avenue for retirees.

- Pradhan Mantri Vaya Vandana Yojana (PMVVY): This pension scheme provides regular income to senior citizens with assured returns, offering financial stability during retirement.

Maximizing Your Retirement Savings

Here are some additional tips to stretch your help you through the retirement planning process and maximise your retirement savings further:

- Start Early: The power of compound interest is immense. Starting early allows you to benefit from compounding over a longer period.

- Increase Your Savings Regularly: As your income grows, allocate a larger portion towards your retirement corpus.

- Review and Rebalance: Periodically review your investment portfolio and rebalance it as needed to maintain your desired asset allocation.

- Seek Professional Advice: Consult financial advisors or retirement planners to tailor a customized retirement strategy aligned with your goals and risk appetite.

- Avail Tax Benefits: Many investment options like PPF, NPS, and ELSS Mutual Funds offer tax exemptions on your contributions.

- Maintain a Contingency Fund: Set aside an emergency fund equivalent to at least six months’ worth of expenses to cushion against unforeseen circumstances.

Retirement Planning Goals Beyond Savings and Investments

While financial planning is crucial, a holistic approach to your retirement planning goals is essential. Consider these aspects as well:

- Health: Maintaining good health reduces medical expenses in your later years. Focus on preventive healthcare and a healthy lifestyle.

- Debt Management: Clear your debts before retirement to avoid financial strain.

- Skill Development: Consider acquiring new skills that could generate income in your retirement years.

Challenges In Retirement Planning Process

Despite awareness, many Indians procrastinate retirement planning due to various reasons. These may include lack of financial literacy, familial responsibilities, or simply assuming that government schemes will suffice. However, relying solely on pension or gratuity may not be adequate to maintain the desired standard of living post-retirement.

Conclusion: Building a Secure and Fulfilling Retirement

Retirement planning in India might seem daunting at first, but with the right knowledge and a proactive approach, you can build a secure and fulfilling future. Remember, your retirement planning goals are more than just about finances. It's about having the freedom and peace of mind to pursue your passions and live life on your own terms.

This blog has equipped you with the essential tools to get started with the retirement planning process. By setting clear goals, choosing the right investment vehicles, and adopting healthy financial habits, you can ensure your golden years are truly golden.

Here's to a future filled with financial security, good health, and the freedom to enjoy the fruits of your labor. Take charge of your retirement planning today, and unlock the door to a fulfilling future!

Read more in Economy

Jul 17, 2025

TUI Staff

Jun 24, 2025

TUI Staff

Jun 22, 2025

TUI Staff

Stay Tuned with The United Indian!

Our news blog is dedicated to sharing valuable and pertinent content for Indian citizens. Our blog news covering a wide range of categories including technology, environment, government & economy ensures that you stay informed about the topics that matter most. Follow The United Indian to never miss out on the latest trending news in India.

©The United Indian 2024